Introduction

Trading is an exciting and potentially rewarding activity that can open up a world of financial opportunities. Whether you’re looking to supplement your income or pursue a full-time career, understanding the basics of trading is the first step on your journey. This guide is designed to help you grasp the fundamental concepts of trading in simple, clear language. Let’s dive in!

What is Trading?

Trading is the act of buying and selling financial instruments like stocks, bonds, or cryptocurrencies with the goal of making a profit. Unlike investing, which typically involves holding assets for the long term to gain from their value appreciation, trading focuses on taking advantage of short-term price movements.

For example, if you buy a stock at $50 and sell it at $60, you’ve made a profit of $10 per share. Trading can be done in various markets, each offering unique opportunities and challenges.

Types of Markets

There are several types of markets where trade takes place:

- Stock Market: This is where shares of publicly listed companies are bought and sold.

- Forex Market: Also known as the foreign exchange market, it’s where currencies are traded.

- Commodity Market: Here, traders buy and sell physical goods like gold, oil, and agricultural products.

- Cryptocurrency Market: This market involves trading digital currencies like Bitcoin, Ethereum, and others.

Types of Trading

Trading can be done in various styles, each suiting different personalities and risk appetites:

- Day Trading: Buying and selling assets within the same day. Day traders take advantage of small price movements and close all positions by the end of the trading day.

- Swing Trading: Holding assets for several days or weeks to profit from expected upward or downward market shifts.

- Position Trading: Holding assets for months or even years, based on long-term market trends.

- Scalping: Making multiple trades throughout the day to profit from very small price changes. This requires quick decision-making and a lot of time.

Trading Instruments

There are various instruments you can trade:

- Stocks: Shares of individual companies.

- Bonds: Debt securities issued by corporations or governments.

- ETFs (Exchange-Traded Funds): Investment funds that hold a collection of assets and trade like stocks.

- Options: Contracts giving the right, but not the obligation, to buy or sell an asset at a set price before a certain date.

- Futures: Contracts obligating the buyer to purchase, or the seller to sell, an asset at a predetermined future date and price.

- Forex: Currencies traded in pairs, like EUR/USD.

- Cryptocurrencies: Digital currencies such as Bitcoin and Ethereum.

Trade Platforms and Tools

To start trading, you’ll need a demat account. There are many online brokers to choose from, offering different platforms and tools. Popular trading platforms include :

For stock trading- ZERODHA ,UPSTOX,GROW,ANGELONE

For forex trading-EXENESS

For cryptotrading -BINANACE,COIN DCX

These platforms provide charting tools, market news, and analysis features to help you make informed decisions.

Basic Trading-Terminology

Understanding key terms is crucial for effective trading:

- Stock: A share in the ownership of a company.

- Market Order: An order to buy or sell a stock immediately at the current market price.

- Limit Order: An order to buy or sell a stock at a specific price or better.

- Bid and Ask: The highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Volume: The number of shares traded during a specific period.

- Bull Market: A market characterized by rising prices.

- Bear Market: A market characterized by falling prices.

- Dividend: A portion of a company’s earnings distributed to shareholders.

- Blue-Chip Stocks: Shares of large, well-established companies.

- ETF (Exchange-Traded Fund): A fund that holds a collection of assets and trades like a stock.

- IPO (Initial Public Offering): The first sale of a company’s stock to the public.

- Portfolio: A collection of investments owned by an individual or institution.

- Diversification: Spreading investments across different assets to reduce risk.

- P/E Ratio (Price-to-Earnings Ratio): A measure of a company’s current share price relative to its earnings per share.

- Market Capitalization: The total value of a company’s outstanding shares.

- Liquidity: How quickly and easily an asset can be converted into cash.

- Margin Trading: Borrowing money from a broker to purchase stocks.

- Short Selling: Selling stocks you do not own, with the intention of buying them back at a lower price.

- Stop-Loss Order: An order to sell a stock when it reaches a certain price to limit losses.

- Technical Analysis: Analyzing statistical trends from trading activity to predict future price movements.

- Fundamental Analysis: Evaluating a company’s financial health and performance.

- Volatility: The degree of variation in a stock’s price over time.

- Candlestick Chart: A price chart that displays the opening, closing, high, and low prices for a specific period.

- Bullish and Bearish: Bullish means expecting prices to rise, while bearish means expecting prices to fall.

- Index: A statistical measure of the performance of a group of stocks, like the S&P 500.

Strategies

Different strategies can be used in trading:

- Fundamental Analysis: Evaluating a company’s financial health by analyzing its financial statements, management, industry conditions, and other factors.

- Technical Analysis: Using historical price and volume data to predict future price movements.

- Quantitative Analysis: Using mathematical and statistical models to identify trading opportunities.

- Sentiment Analysis: Gauging market sentiment to predict price movements.

Risk Management

Effective risk management is crucial in trading:

- Stop-Loss Orders: Automatically sell a stock when it reaches a certain price to limit losses.

- Position Sizing: Determining the amount of money to invest in a particular trade.

- Diversification: Reducing risk by spreading investments across different assets.

- Risk/Reward Ratio: Comparing the potential profit of a trade to the potential loss.

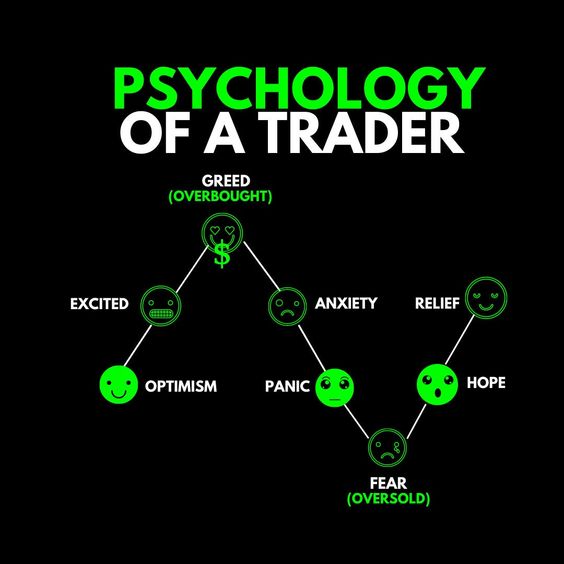

Psychology

Trading can be emotionally challenging. Here are some tips:

- Emotional Discipline: Stay calm and stick to your trading plan.

- Overcoming Fear and Greed: Avoid making impulsive decisions based on emotions.

- Developing a Trading Plan: Set clear goals and strategies.

- Staying Informed and Educated: Continuously learn and adapt to market changes.

Building a Plan

A solid trading plan is essential for success:

- Setting Goals: Define what you want to achieve with your trading.

- Choosing a Trading Style: Decide whether you prefer day trading, swing trading, position trading, or scalping.

- Developing Entry and Exit Strategies: Determine when to buy and sell assets.

- Monitoring and Adjusting the Plan: Regularly review and adjust your plan based on performance.

Legal and Ethical Considerations

It’s important to trade legally and ethically:

- Understanding Regulations: Know the rules and regulations governing trading.

- Avoiding Insider Trading: Do not trade based on non-public, material information.

- Ethical Trading Practices: Trade honestly and transparently.

Conclusion

Understanding the basics of trading is the first step toward becoming a successful trader. With a solid foundation, you can build your knowledge and skills over time. Keep learning, stay disciplined, and remember that successful trading requires patience and persistence. Happy trading!

By following this guide, you’ll be well on your way to navigating the world of trading with confidence and clarity. Good luck!