In the world of trading, understanding order types in trading is crucial for effective market participation. This article will break down the two primary order types: MIS (Margin Intraday Square-off) and CNC (Cash and Carry). We will explore their definitions, uses, and differences, helping you make informed trading decisions.

What are Order Types in trading?

Order types are essential instructions that traders give to brokers regarding how to execute trades. The two most common types are MIS and CNC. Knowing when to use each type can significantly impact your trading success.

Order Selection: Buy or Sell

When placing an order, the first decision is whether to buy or sell. A buy order is placed when you want to enter a position, while a sell order is used to exit a position. Understanding this basic functionality is the first step in mastering order types.

Buy Orders

Buy orders are placed when traders anticipate that the price of a security will rise. This allows them to purchase shares at a lower price and sell them at a higher price later.

Sell Orders

Conversely, sell orders are executed when traders expect the price to fall. By selling shares they already own, they can avoid losses or realize gains.

Types of Orders: MIS and CNC(NRML)

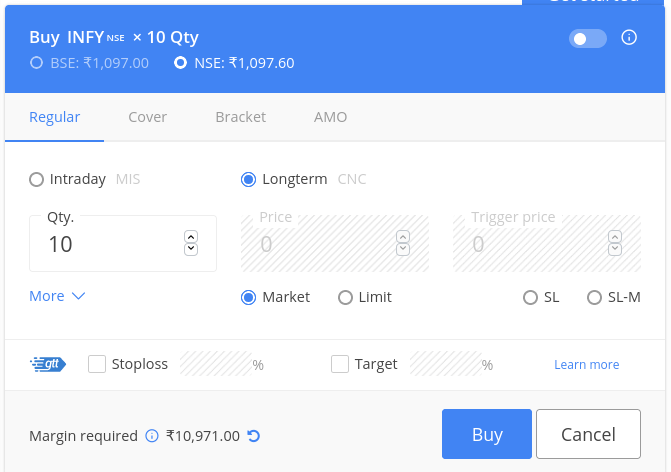

After deciding whether to buy or sell, you must choose between MIS and CNC. Each order type serves different trading strategies and risk profiles.

MIS (Margin Intraday Square-off)

MIS orders are designed for intraday trading. They allow traders to leverage their capital by using margin. This means you can control a larger position with a smaller amount of capital.

- Intraday trading focus

- Use of margin for leverage

- Must exit positions by market close

- Automatic square-off by broker

For example, if you buy shares worth ₹1 lakh using MIS, you may only need ₹20,000 as margin. This makes it an appealing option for active traders looking to maximize their capital efficiency.

CNC (Cash and Carry)/NRML

CNC orders are suitable for swing trading or long-term investments. Unlike MIS, CNC orders require full payment for the shares purchased.CNC is otherwise known as NRML .

- Suitable for swing trading

- Requires full capital upfront

- Position can be held overnight

- No automatic square-off

If you buy shares worth ₹1 lakh with CNC, you need to have the entire ₹1 lakh in your account. This order type is ideal for traders who plan to hold positions for longer durations.

Key Differences Between MIS and CNC

Understanding the differences between MIS and CNC is vital for traders. Here are the primary distinctions:

- MIS allows for intraday trading; CNC is for longer-term holding.

- MIS uses margin; CNC requires full capital.

- MIS positions are automatically squared off; CNC positions are not.

- MIS is suited for active traders; CNC is for swing traders.

These differences dictate how traders approach their strategies and manage their risks. Choosing the right order type can enhance your trading performance.

Practical Application of Orders

Now that we understand the theoretical aspects of MIS and CNC, let’s discuss their practical applications in trading.

When to Use MIS

MIS is best for traders who are actively monitoring the market and can execute trades throughout the day. Here are some scenarios where MIS is advantageous:

- Short-term market movements

- Quick profit opportunities

- High volatility trading

- Limited capital resources

Traders using MIS should be prepared to exit their positions before the market closes. Failure to do so may result in automatic square-off at the current market price, which could lead to unexpected losses.

When to Use CNC

CNC is ideal for traders who prefer a more relaxed trading style. Here are some situations where CNC is beneficial:

- Long-term investment strategies

- Holding positions over several days

- Less active market monitoring

- Full capital availability

With CNC, traders can carry their positions overnight or longer, which allows for more strategic planning and less pressure to react quickly to market changes.

Conclusion

In conclusion, understanding the differences between MIS and CNC is essential for any trader. Each order type serves a specific purpose and caters to different trading styles. By choosing the appropriate order type, you can optimize your trading strategy and enhance your chances of success in the market.

Whether you are an intraday trader or a swing trader, knowing when to use MIS or CNC can make a significant difference in your trading outcomes. As you continue to learn and grow in your trading journey, keep these order types in mind and apply them accordingly.

If this article is helpful to you please comment for part 2

THANK YOU FOR READING TILL NOW !