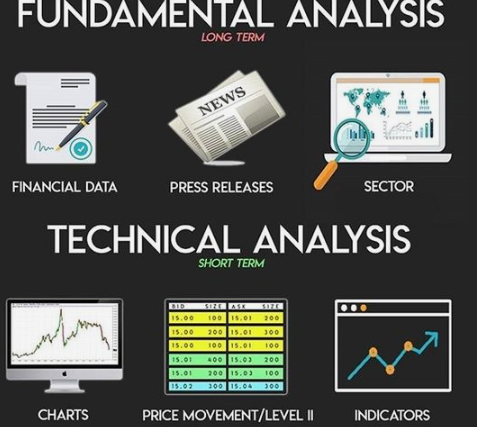

In this guide of Fundamental Analysis vs. Technical Analysis we will explore what each type of analysis entails, how they differ, and when to use them effectively.When it comes to investing in stocks, understanding the difference between fundamental analysis and technical analysis is essential. Both methods offer unique insights, but they approach market analysis from different angles.

Understanding Fundamental Analysis

Fundamental analysis focuses on evaluating a company’s financial health and its intrinsic value. This involves examining various factors, including financial statements, management performance, and market conditions. Investors analyze these factors to evaluate a stock’s true worth and determine if it is currently over or undervalued.

- Company’s financial statements

- Management performance

- Market conditions

- Profit margins

- Revenue growth

Fundamental analysts look at historical data to assess a company’s profitability over the last few years. They try to identify future growth potential by analyzing upcoming projects and market trends. This assessment helps investors make informed decisions based on the company’s overall performance and potential.

The Importance of Intrinsic Value

Fundamental analysis is about finding a stock’s true worth. This refers to the actual worth of a company based on its financials rather than its current market price. Knowing a stock’s true worth helps investors decide if it’s a good investment.

For instance, if a company’s intrinsic value is significantly higher than its current market price, it may indicate that the stock is undervalued. Conversely, if the market price exceeds the intrinsic value, the stock may be overvalued, signaling a potential sell opportunity.

Challenges of Fundamental Analysis

While fundamental analysis can provide valuable insights, it is not without challenges. Evaluating a company’s financial health requires a deep understanding of financial statements, which can be complex. Additionally, different industries may have varying metrics for success, making comparisons difficult.

Investors must also consider external factors, such as economic policies and market trends, which can impact a company’s performance. Fundamental analysis requires deep research and a good grasp of the market.

Exploring Technical Analysis

Unlike fundamental analysis, technical analysis focuses on price movements and trading volume. Technical analysts study historical price charts to identify patterns and trends that may indicate future price movements. This approach is based on the belief that market sentiment and psychology drive price changes.

- Price movements

- Trading volume

- Chart patterns

- Support and resistance levels

- Market trends

Technical analysts use special tools and charts to predict future stock prices based on past price patterns. By analyzing these patterns, traders can make informed decisions about when to buy or sell a stock.

Key Concepts in Technical Analysis

A key idea in technical analysis is understanding support and resistance levels. Support levels indicate where a stock’s price tends to stop falling, while resistance levels indicate where it tends to stop rising. Understanding these levels helps traders identify potential entry and exit points.

Moreover, technical analysis often involves the use of charting techniques to visualize price trends. There are three main types of charts: line, bar, and candlestick. Each chart type provides different insights into price movements and market behavior.

Advantages of Technical Analysis

Technical analysis offers several advantages for traders. Firstly, it allows for quick decision-making based on real-time data. Unlike fundamental analysis, which can take time to gather and interpret, technical analysis provides immediate insights into market trends.

Additionally, technical analysis can be applied to various markets, including stocks, commodities, and cryptocurrencies. This flexibility makes it a popular choice for day traders and short-term investors.

Comparing Fundamental analysis vs. Technical Analysis

Both fundamental and technical analysis have their merits, but they serve different purposes. Understanding their differences is crucial for investors looking to enhance their trading strategies.

Approach to Analysis

Fundamental analysis takes a long-term approach, focusing on a company’s financial health and growth potential. It requires in-depth research and analysis of financial statements and market conditions.

In contrast, technical analysis is more short-term and reactive. It focuses on price movements and market sentiment, allowing traders to make quick decisions based on real-time data.

Investment Goals

Fundamental analysis is ideal for long-term investors looking to build a portfolio of undervalued stocks. It helps identify companies with strong fundamentals that are likely to perform well over time.

Technical analysis, on the other hand, is suited for active traders seeking to capitalize on short-term price movements. This helps traders decide when to buy or sell a stock based on price patterns.

Market Behavior

Fundamental analysis assumes that the market will eventually recognize a company’s true value, leading to price adjustments over time. In contrast, technical analysis relies on the idea that price movements reflect market sentiment, which can be influenced by various factors, including news and events.

When to Use Each Analysis Method

Choosing between fundamental and technical analysis depends on your investment goals and trading style. Here are some tips to help you choose…

- If you’re a long-term investor, focus on fundamental analysis.

- If you’re a short-term trader, use technical analysis.

- Combine both methods for a comprehensive approach.

- Use fundamental analysis to select stocks; apply technical analysis for entry/exit points.

By understanding both methodologies, investors can create a balanced approach to trading that leverages the strengths of each analysis type.

Conclusion

In conclusion, both fundamental and technical analysis are vital tools for investors and traders. Fundamental analysis provides insights into a company’s financial health and long-term growth potential, while technical analysis focuses on price movements and market sentiment. Understanding the strengths and weaknesses of each approach allows investors to make informed decisions tailored to their investment strategies.

Whether you choose to focus on one method or combine both, having a solid grasp of these analytical techniques will enhance your trading success. Remember, the key to effective investing lies in continuous learning and adapting to market changes.

Hey there! Someone in my Facebook group shared this site with us so I came

to give it a look. I’m definitely loving the information. I’m bookmarking and will be

tweeting this to my followers! Terrific blog and amazing design and style.

After I initially commented I appear to have clicked on the -Notify me when new comments are added- checkbox and from now on each

time a comment is added I get four emails with

the same comment. Is there an easy method you are able to remove me from that service?

Cheers!

I have read so many articles regarding the blogger lovers but this article is actually a pleasant post,

keep it up.

I visit every day a few web sites and websites to read content, except this blog provides quality based

articles.

naturally like your web-site however you have to test the spelling on several of your posts.

Several of them are rife with spelling issues and I in finding it very troublesome

to tell the truth nevertheless I will certainly come again again.

Hi, I want to subscribe for this webpage to get most up-to-date

updates, so where can i do it please assist.

You’ve made some decent points there. I checked on the web

to find out more about the issue and found most individuals will go along with your views on this site.