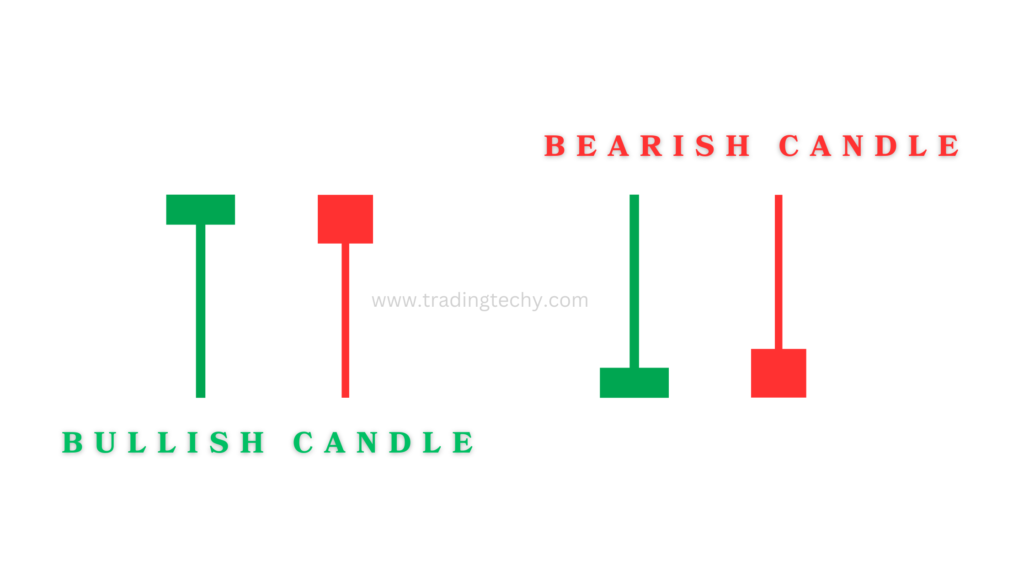

Understanding how to read candles is crucial for anyone looking to master price action trading. Candlestick reading represent price movement and can give traders insights into market sentiment and potential future price behavior. This blog will provide a comprehensive analysis of bullish and bearish candlesticks, exploring their characteristics and effective interpretation techniques.

Understanding Bullish Candles

Bullish candles indicate buying pressure and signify that buyers are aggressive in the market. When you see a bullish candle, it often suggests that the price is likely to rise. Let’s explore the different types of bullish candles and what they can tell us about market conditions.

Characteristics of a Bullish Candle

A bullish candle typically has the following characteristics:

- Price opens lower and closes higher.

- Indicates strong buying pressure.

- Can have a long lower wick.

When analyzing a bullish candle, consider the following variations:

1. Strong Bullish Candle

A strong bullish candle opens at one price level and rises significantly without any selling pressure. This indicates a strong bullish sentiment where buyers dominate the market.

2. Bullish Candle with a Long Lower Wick

This scenario occurs when the price opens lower, dips down, but buyers push the price back up. The long lower wick signifies that even though sellers tried to push the price down, buyers were strong enough to bring it higher.

3. Bullish Candle with Selling Pressure

Occasionally, a bullish candle can still show signs of selling pressure. For example, if the candle opens higher and closes lower than its opening price but still remains bullish due to a significant lower wick, it indicates that buyers are still committed despite some selling activity.

Understanding Bearish Candles

Bearish candles, on the other hand, represent selling pressure.These patterns suggest strong selling pressure, indicating a potential downward price movement. Let’s break down the types of bearish candles and their implications.

Characteristics of a Bearish Candle

Bearish candles generally have the following features:

- Price opens higher and closes lower.

- Indicates strong selling pressure.

- Can have a long upper wick.

Bearish candles can also vary in appearance and meaning:

1. Strong Bearish Candle

A strong bearish candle opens at a certain price and declines significantly without much buying pressure. This indicates a strong bearish sentiment where sellers control the market.

2. Bearish Candle with a Long Upper Wick

This type occurs when the price opens lower, rises, but sellers push it back down before closing. The long upper wick indicates that buyers attempted to push the price up, but sellers were strong enough to bring it down again.

3. Bearish Candle with Buying Pressure

Sometimes, a bearish candle may show some buying pressure. For instance, if the candle opens lower and closes higher than its opening price but still appears bearish due to a significant upper wick, it indicates that sellers are still dominant, but buyers are trying to intervene.

Interpreting Wicks: Buying and Selling Pressure

Wicks play a critical role in understanding market pressure. They can provide insights into potential reversals and the strength of buyers or sellers. Here’s how to interpret them:

Long Lower Wicks

A long lower wick on a candle signifies strong buying pressure. It suggests that even though the price dipped, buyers stepped in to push it back up. This is often a bullish signal.

Long Upper Wicks

Conversely, a long upper wick indicates strong selling pressure. It shows that buyers pushed the price up but sellers stepped in to bring it down before the candle closed. This can be a bearish signal.

Identifying Market Sentiment

Understanding the sentiment behind the candles is essential for making informed trading decisions. Here are some key points to consider:

- Consistent bullish candles indicate strong buying sentiment.

- Consistent bearish candles indicate strong selling sentiment.

- Wick lengths help identify potential reversals.

For example, if a series of bullish candles is followed by a candle with a long upper wick, it may signal that selling pressure is increasing. Traders should be cautious and look for confirmation before making decisions.

Practical Application: Analyzing Charts

While understanding the theory behind candles is essential, applying this knowledge to real charts is where traders can truly benefit. Here are some practical steps to analyze candle patterns:

- Identify the overall trend (bullish or bearish).

- Observe individual candles and their wicks.

- Look for patterns such as consecutive bullish or bearish candles.

- Consider the context of each candle in relation to previous ones.

- Combine candle analysis with other technical indicators.

By following these steps, traders can better understand how the market moves and make smarter choices.

Common Misconceptions in Candlestick Reading

Many traders rely heavily on specific candlestick patterns, but this can lead to mistakes. Here are some misconceptions to avoid:

- Believing all hammers indicate a bullish reversal.

- Assuming shooting stars always lead to bearish moves.

- Relying solely on candle patterns without context.

Instead, it’s crucial to understand the underlying market pressure and sentiment behind each candle. This comprehensive approach will lead to better trading outcomes.

Conclusion

Candlestick reading is an integral part of mastering price action trading. By understanding the characteristics of bullish and bearish candles, interpreting wicks, and recognizing market sentiment, traders can make informed decisions. Candlestick patterns offer valuable insights into market sentiment, but they should not be the sole determinant of trading decisions. Always consider the broader market context and combine your analysis with other technical tools for the best results.

Embarking on this journey of understanding price action will empower you to navigate the markets with confidence. Happy trading!

Thank you I have just been searching for information approximately this topic for a while and yours is the best I have found out so far However what in regards to the bottom line Are you certain concerning the supply

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but instead of that this is excellent blog A fantastic read Ill certainly be back

Normally I do not read article on blogs however I would like to say that this writeup very forced me to try and do so Your writing style has been amazed me Thanks quite great post